Tariffs of 30% on South African goods entering the US market came into effect on 1 September - ending over 25 years of duty-free access for many goods under AGOA.

South Africa is one of the worst affected countries globally, and the tariffs come at a time when the South African economy continues to stagnate, and doesn’t have any jobs to spare. The South African government has scrambled to negotiate with the White House, but has largely been ignored, with their proposals being deemed ‘not ambitious enough’. Although recent reporting suggests that a breakthrough might be imminent, I’ll believe it when I see it.

As the trade data become available over the next few months, I thought it would be useful to set the stage and look at the history of exports of key goods to the United States, and see what South Africa potentially has to lose.

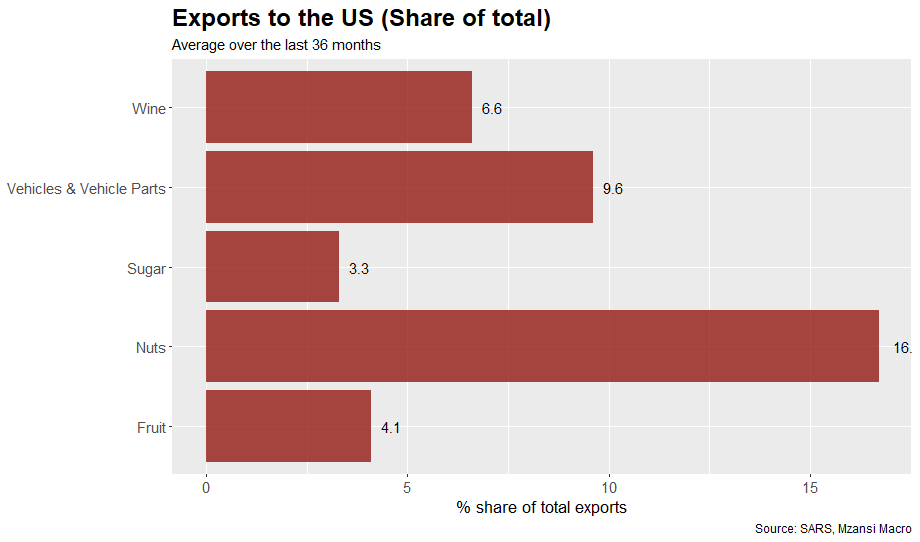

I’m going to touch on some of the sectors or product types South Africa exports to the US, that are most at risk. Most notable are Vehicles & Vehicle Parts and Nuts, which are larger than I expected: 16% of all South African nuts go to the US (three-year average, customs rand value) and just under 10% of vehicles and parts. Other key agricultural products are Fruit (4.1%), Wine (6.6%), and Sugar (3.3%).

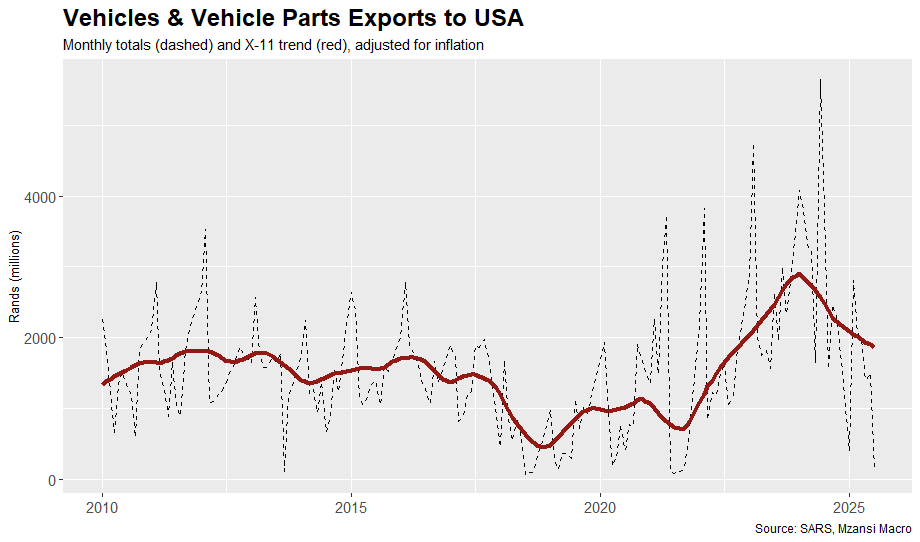

Vehicles and vehicle parts

In terms of Rand value of exports, the most important and at risk sector is the local vehicle manufacturing industry, with an average of around R2 billion exported to the US per month, over the last year or so. A 25% tariff has already been levied on the vehicle manufacturing industry in April this year, so we can already see some of the fallout, which will be a precursor to the other sectors. Note the last few data points - year to date (Jan - July 2025), exports are down 59.7% in real terms, which is significant, and has perpetuated a reversal in the upward trend towards the end of 2024.

How U.S. Tariffs Will Hit Key Products

How U.S. Tariffs Will Hit Key Products

This is an industry that previously benefited from duty-free access under AGOA and saw fantastic growth between 2021 and 2024, with the manufacture of parts such as catalytic converters spearheading this growth. According to the National Association of Automotive Component and Allied Manufacturers (Naacam), around 30 000 jobs are at risk.

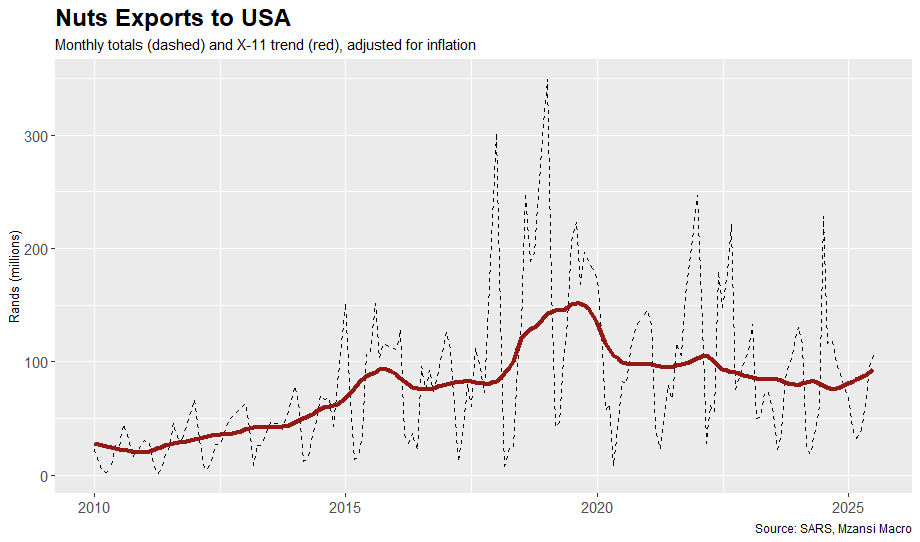

Nuts

South Africa exported just under R100 million of nuts per month, on average to the US over the last year, and while specific nuts such as macadamia nuts have reportedly experienced good growth due to favourable weather conditions, year to date, exports to the US are down 28.7%, and the outlook isn’t good. The global nut industry is competitive and producers are typically quite price sensitive, so an increase in the tariff from 10% to 30% is going to eat into margins quite significantly. The tariff will also significantly reduce South Africa’s competitiveness relative to Australia, which faces a 10% tariff, for example.

As shown in Figure 1, the US is an extremely important customer for the local nut industry, with 16% of nuts going to the US over the last 3 years on average. This is reportedly going to put around 5000 jobs at risk.

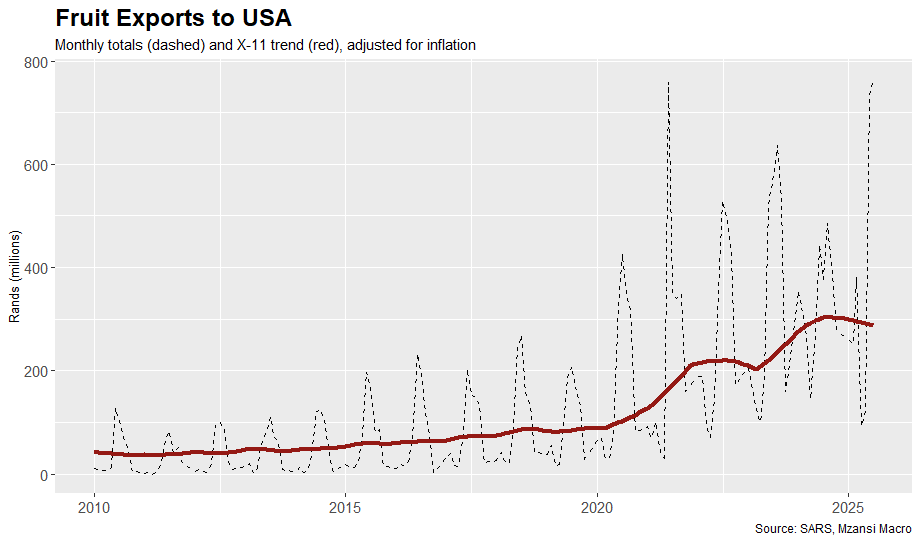

Fruit Figure 4: Customs Value (real) of fruit (fresh and dried) exports to the US, monthly and trend (using X-11 method), adjusted for inflation.

Figure 4: Customs Value (real) of fruit (fresh and dried) exports to the US, monthly and trend (using X-11 method), adjusted for inflation.

The US has become an increasingly important market for the local fruit industry, with exports increasing six-fold over the last 15 years, from just R50 million per month in 2010, to just under R300 million in 2024 (in real terms, adjusted for inflation). The US only used to make up 2% of total fruit exports in the 2010’s, which has doubled to 4% in the 2020’s. South Africa mainly exports citrus, grapes and apples to the US, and recently had its best month on record in July, exporting R764 million of fruit to the US, apparently due to a bumper citrus crop, and exports for the year to date are up 20.2%.

While the US only accounts for 4% of exports, they remain a valuable customer in South Africa’s ‘off season’, when the US leans more on Southern Hemisphere suppliers. According to the Citrus Growers' Association of Southern Africa, the tariffs could ‘affect’ around 35 000 jobs. This is quite a high estimate - the US isn’t a big enough market to directly affect that many jobs, and it’s more around 5000 in my opinion. Nonetheless, many of South Africa’s competitors only face 10-15% tariffs (Spain, Chile, Peru, Australia), making the local industry less competitive.

Wine

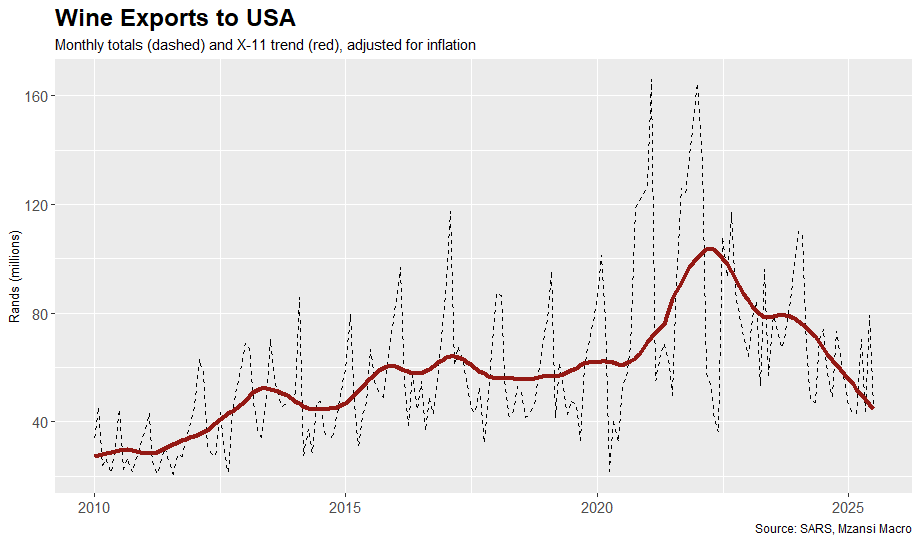

Although South African wine seems to have quite significantly fallen out of favour in the US over the last 3 years, the US is still the fourth biggest export market and remains an important customer for South African wine producers, with 6.6% of exports going to the US over the last 3 years on average. The negative trend has continued in 2025 so far with wine exports to the US down by 29.4% year to date, in real terms. Like other industries already mentioned, the tariffs are going to have a devastating effect on local producers ability to compete at price points that have been carefully established over years.

Many of the wine industry’s competitors have only been subject to 10% or 15% tariffs, including Chile (10%), Argentina (10%), Australia (10%) and the EU (15%) for example, making South African wine a lot less competitive, in an industry with already tight margins, putting around 10 000 jobs at risk according to Wines of South Africa.

Conclusion Trade relations between South Africa and the US are at historic lows following the introduction of these tariffs, and came to a crescendo as President Cyril Ramaphosa and his delegation were ambushed at the White House. The Trump administration seems to be using tariffs as a political weapon, and unless the local industries mentioned above can find new markets for their goods, there will undoubtedly be job losses. Early data already point to declines in US-bound shipments and unless some sort of relief is secured, exporters are going to have to discount, divert, or downscale.